SCOTLAND AND THE TWENTIETH CENTURY

Introduction

Despite huge changes in the role of Government spending throughout the 20th century, largely from funding the military and national debt, to the funding of the welfare system and the NHS, the consensus of opinion from economists and historians alike is that Scotland has benefited from fiscal transfers due to being part of the UK during this period.

This article collates and presents the available data sources and looks further into this position. For example, the conclusions by T.M Devine and G.C. Peden in the 'Transformation of Scotland - The economy since 1700' [1]

state:

'From the early 1920s identifiable public expenditure per head in Scotland was higher than England and Wales, and apart from a period in the 1980s when tax revenues were high, Scotland benefited from net fiscal transfers within the UK'

Gavin McCrone, in his 1999 paper 'Scotland's public finances from Goschen to Barnett' [2], has also stated that all academic studies that have analysed the numbers, 'show locally identifiable public expenditure per head in Scotland well above the average for the UK; and, therefore, even more above the average for England'.

1900 to 1921

From 1900 to 1921 the UK Treasury produced a return to the House of Commons entitled Revenue and Expenditure (England, Scotland and Ireland).

As this was prior to Ireland leaving the United Kingdom, these returns were broken down into the three Kingdoms of England, Scotland and Ireland. As was the practice at the time, the figures for Wales were included in the figures for England.

Clearly these were very different times in the life of the UK. The British Empire was at its height and there was barely any welfare state and no National Health System. As such, the tax and expenditure profile for the UK looked very different to today.

We will use 1899-1900 as an example to illustrate this.

Revenue 1899-1900

Unlike today, the bulk of government income was from Customs and Excise with income tax only forming 15% of total taxation, whereas today Income tax and National Insurance make up 42% of the total.

- Customs (Import Taxes) alone made up for 18% of 1899-1900's revenue, largely fueled by the UK's insatiable appetite for tea, tobacco and foreign spirits.

- Excise duties are made up of taxes on the UK production and sale of certain goods such as whisky and beer. These netted the exchequer 25% of all revenue.

- Estate Duty was imposed on inheritance of land and other properties. This was, remarkably, responsible for 11% of all government income, compared to just under 1% for 2016-2017.

- The remainder of government tax income was made up of Stamp Duty, Land Taxes and House Duty.

The UK government also received substantial non-tax income, 16%, from sources such as the Post Office, the Telegraph Service and Suez Canal.

The UK's total government income in 1899-1900 was £128,813,000. This represents around 10% of GDP, compared to government income of 33.2% of GDP in 2016.

Expenditure 1899-1900

As well as there being vast differences in the revenue profile, government expenditure also had a very different composition to today:

- The Navy and the Military, alone, accounted for 48% of all government spending.

- The national debt accounted for a further 16%.

- Running the post office amounted to 9%, while facilitating the collection of taxes made up 2% of all government spend.

- The consolidated fund, largely paying for the civil list and key government positions, amounted to 1%, leaving 16% of spend for 'voted' spending.

- As this was prior to any functioning welfare state or National Health System, the largest single cost in this voted spending was public education, at 8% of all UK spending.

Comparing these numbers to 2016-2017, where defence spending was only 4.8% of the total and debt repayments were only 5.1%, we can see how very different the role of the UK Government was at the turn of the 20th century.

Total UK expenditure in 1899-1900 was £143,687,000, leading to a deficit of £14,874,000.

As we can see from charts below, over the 21 years from 1900 to 1921 this distribution of revenue sources changed somewhat with a gradual decrease of income from Customs and Excise and an increase in both personal taxation and corporate taxes, including the introduction of an Excess Profits Duty in 1915-1916.

Government expenditure, as demonstrated in the following charts, throughout this period continued to be dominated by National Debt and Military spending. 'Votes of Credit' were used during the war years to fund the war effort and reduce the need for individual budgets to be agreed and debated in parliament. These Votes of Credit covered the bulk of Army, Navy and Air Force spend throughout this period.

Scotland's Contribution

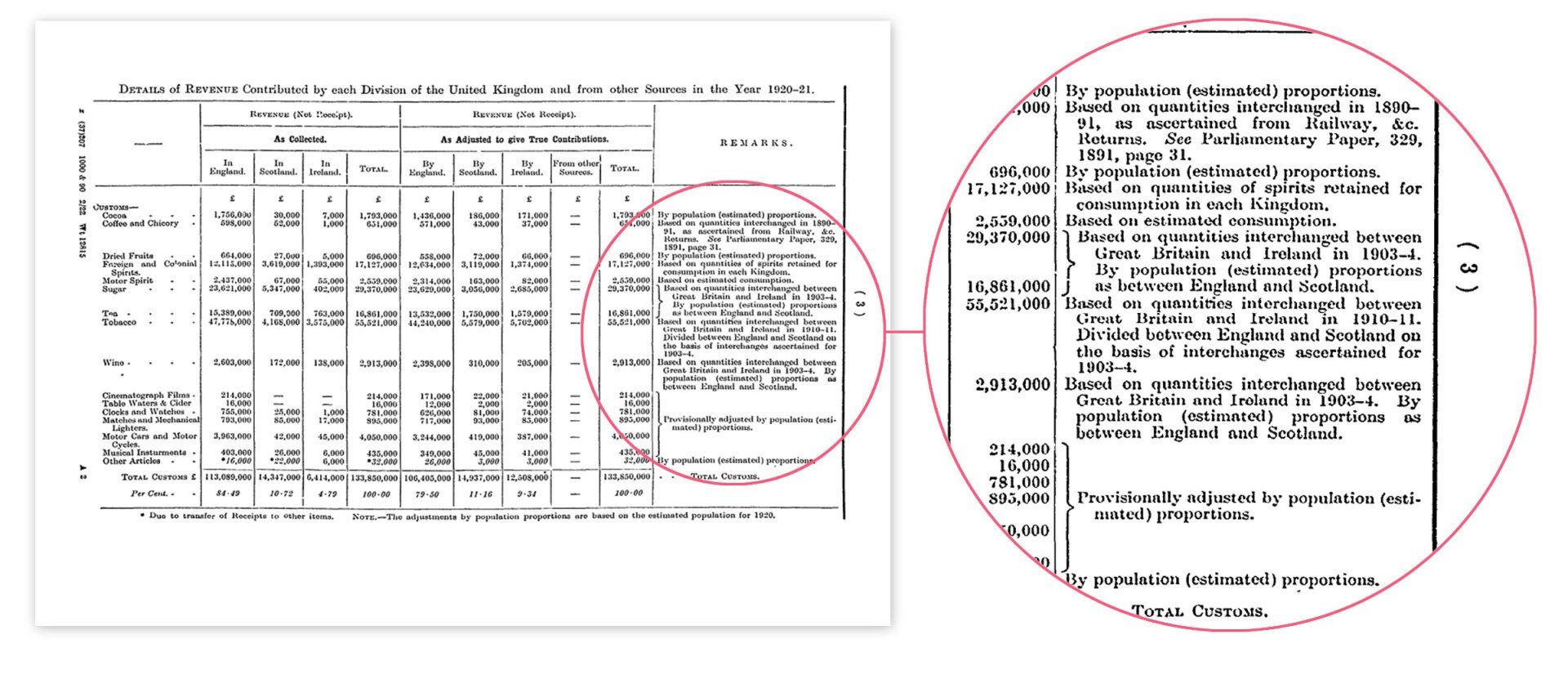

Much like the Government Expenditure Revenue Scotland (GERS)

does today, the Revenue and Expenditure (England, Scotland and Ireland)

publications estimate the 'Revenue as Contributed', as well as the 'Revenue as Collected' by the constituent countries.

'Revenue As Collected' refers to where taxes were administered, whereas 'Revenue As Contributed' provides a better estimation of the true contribution. This is described in the Catto report [4] as:

As regards government revenue, the sums collected in Scotland cannot be regarded as the true contribution made by the people of Scotland to the United Kingdom Exchequer. For example it is generally accepted that the incidence of indirect taxation is determined by the consumption of the goods and services on which it is levied rather than by the place of collection. Thus the revenue contributed by residents of Scotland by way of indirect taxes such as customs and excise duties is determined by their purchases of dutiable articles and not necessarily by the amount collected in Scotland under these heads of taxation. The most important indirect taxes are in fact collected, not at the point of retail sale, but at some earlier stage in the process of production and distribution as, for instance, when dutiable goods are cleared through Customs at the port of entry, leave a bonded warehouse or pass from wholesaler to retailer. For this reason indirect taxes borne by residents of Scotland may be collected in England or Northern Ireland and vice versa. Nor is Scotland’s contribution to direct tax receipts necessarily the same as the amount collected in Scotland.

We will use the 'Revenue as Contributed' statistics in this analysis.

There is no accompanying detailed methodology document, instead of this there are annotations in the margins such as:

Some of the language in the documents is a little archaic, for example 'Imperial Expenditure' is used to refer to what we would now call 'Non-Identifiable' expenditure. Non-identifiable expenditure is a term used by HM Treasury to refer to spending that cannot be allocated as benefitting a particular region.

Identifiable expenditure was largely driven by the Goschen formula. The Goschen formula was based on a speech by the Chancellor G.J. Goschen in 1888 and applied a spending ratio to England, Scotland and Ireland of 80, 11 and 9. However, much like today, this only really applied to planned departmental budget (DEL in the language of today) and was frequently eclipsed by demand led expenditure (AME in the language of today) and contingency spending such as Law and Order costs for Ireland.

Unlike the GERS methodology there is no attempt made to allocate non-identifiable spending 'for' Scotland rather than 'in' Scotland. Therefore, in these returns, Scotland's expenditure does not include a share of the Army or Navy Spend, nor indeed any of the National Debt.

It is also worth noting, for the wider impact on the Scottish economy, that as we are looking at government revenue and expenditure only there is no attempt made to allocate non-identifiable government expenditure to private industry based in the component countries. This is significant, for example, the Clyde was a major player in the ship building sector and naval spend accounted for an average of 21% all government spend and 28% of 'Imperial Services' spend over this period. In his book Warship Building on the Clyde [3], the historian, H.B. Peebles, states the shipyards of the Clyde built approximately 40% of all warships from 1890 to 1939. T.M Devine also states that 'During the years 1914-18 Scottish Industry became a vast military arsenal for the greatest conflict in human history'' [3]. Consequently, Scotland's industry prospered greatly from Government spend on Imperial Services over this period.

If we set aside the impact of imperial service spend on the wider economy and focus on revenue and expenditure only then we can perform some basic analysis to determine Scotland's relative contribution and costs.

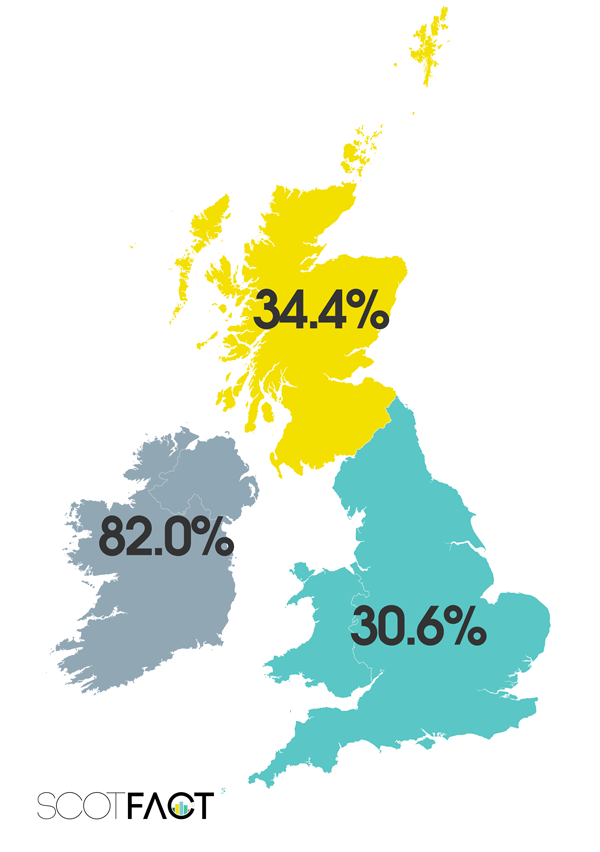

In the chart below, we can see that while the year-by-year numbers vary slightly, identifiable government expenditure directly in Scotland and England was slightly higher as a proportion of revenue raised, as an average of 30.6% in England and 34.4% in Scotland. Ireland's proportional spend was much higher, on average, at 82%.

AVERAGE EXPENDITURE AS A PERCENTAGE OF REVENUE

1900-1921

We can calculate Revenue and Identifiable expenditure per head using the population numbers provided by the Bank of England in their Millennium of Data

publication [5].

Identifiable expenditure taken in isolation does not provide us with the complete figures as this ignores the majority of government spending in this period. To obtain a fuller fiscal balance of each component country we need to assign a population share of non-identifiable government expenditure. In addition to this we will also assign a population share of non-regionally allocated Revenue (referred to as 'Other Sources' in the returns) such as the Suez Canal, The Royal Mint, Sales of War Property, War Reparations etc. to the revenue of the component countries. This results in the following expenditure and revenue figures per head for 1899-1921:

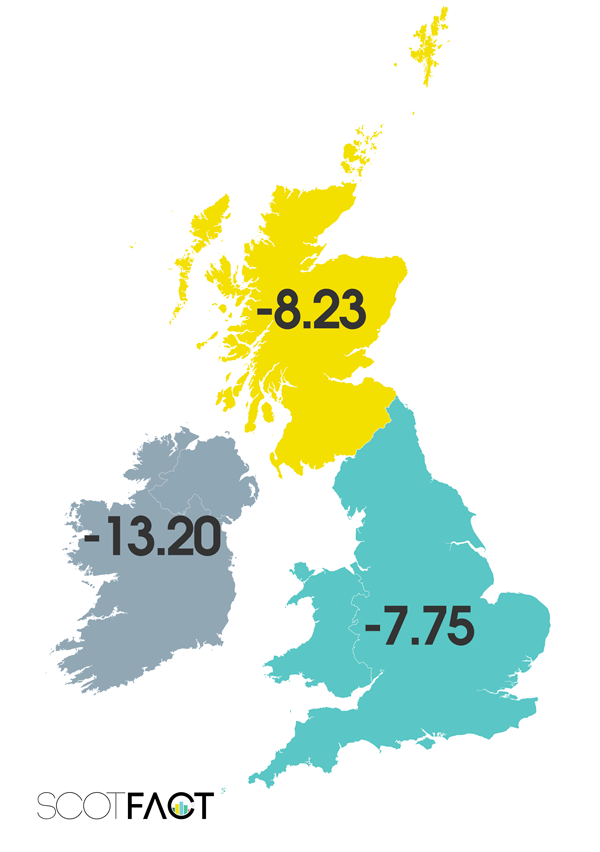

We can use these combined revenue and expenditure numbers to determine, a net fiscal balance (Surplus or Deficit) for the three countries over the period, as illustrated in the following charts:

AVERAGE FISCAL BALANCE PER HEAD

(£ REAL TERMS 1917)

1900-1921

1921 to 1944

As the reports produced from 1900 to 1921 were largely to inform discussions on financial relations between England and Ireland, these ceased to be produced after the passing of the Government of Ireland Act in 1920 (Catto p52 [4]) .

However, similar numbers were produced for 1931-1932 and 1934-1935.

The figures for 1931-1932 show that, for the total revenue raised in England & Wales and Scotland, Scotland raised 8.5% of the revenue and England and Wales raised 91.5% of revenue. Of the total local expenditure between the two, Scotland received 12.2% and England & Wales received 87.8%.

62.8% of revenue raised in Scotland was spent on Identifiable Scottish Expenditure – a rise from an average of 34.4% from 1899 to 1921. 42.0% of revenue raised in England & Wales was spent on identifiable English and Welsh expenditure, a rise from an average of 30.6% between 1889 and 1921. These increases are explained by the expanding role of Government in the well-being of the nation, including The Ministry of Health (Department of Health in Scotland), Old Age Pensions and the Ministry of Labour.

In this period Northern Ireland's revenue and expenditure were not broken down and fell under the 'Other Sources' of revenue category and 'Imperial Expenditure' expenditure classification, it is therefore not possible to list them separately here.

During this period, the Goschen Formula continued to apply to Scotland's public expenditure.

Of the 'Imperial Services', now called 'General Services' in 1931-1932 the bulk of spending was National Debt (64.9%) and Military Spending, (21.7%), although war pensions were playing an increasing role (10.0%) in this non identifiable spend.

1945-1979

The post-war years saw dramatic changes in the profile of government expenditure.

While an annual breakdown was not produced covering this period, the Catto committee [4] was tasked in 1950 to look into the feasibility of producing detailed breakdowns of Scotland's revenue and expenditure, as well as export and imports and balance of payments. This report concluded that the 'Revenue as Contributed' method as used in the returns for 1900 to 1921, 1932-1933 and 1934-1935 was more representative of the actual contribution than the 'Revenue as Collected' approach. For example, on income tax:

'We consider, therefore, that in determining Scotland's true contribution to the income tax receipts of the United Kingdom regard should be paid, not to the amounts of tax collected in Scotland, but to the tax paid on the incomes received by residents of Scotland irrespective of where it is assessed and collected'. - Catto Report p7 [4].

And for expenditure the statement is made that:

'For the purpose of part (i) of our terms of reference we decided to proceed on the basis that government expenditure in Scotland should include:- (a) the whole cost of administering distinct services the direct benefit of which falls to residents of Scotland or to Scotland considered as a separate entity; and (b) those parts of the costs of services operated by departments covering the whole of the United Kingdom which can be identified as the costs of rendering those services for the benefit specifically of residents of Scotland or of Scotland as a separate entity.' - Catto p8 [4].

This approach was used to produce the 1952-1953 report and the spirit of which is still used in the GERS report today.

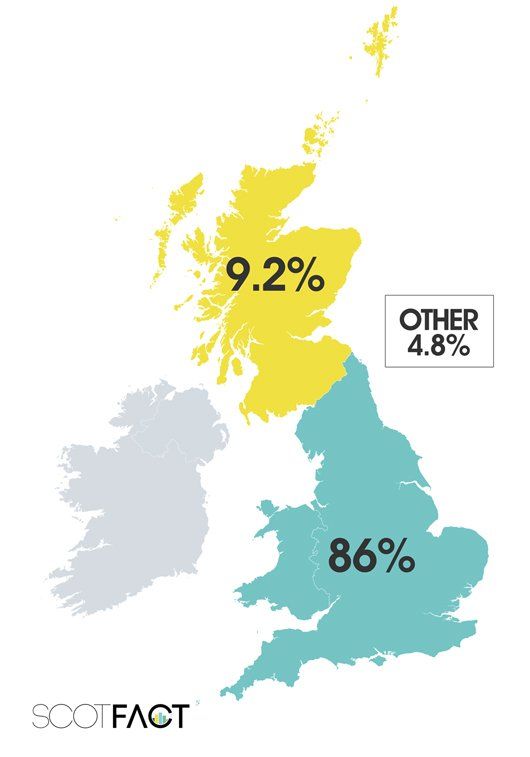

The return for 1952-53 shows that Total UK Revenue was £4,438,715,000, with 9.2% coming from Scotland and 86% coming from England and Wales. Total Expenditure was £4,308,425,000 with 34% of total expenditure being assigned to England and Wales and 4.8% assigned to Scotland, and with 61% being spent on 'General Services' (what used to be called 'Imperial Services', now known as non-identifiable spend) such as National Debt, The Military and Central Government. However, unlike the reports in the early century, in this report Northern Ireland was not identified separately and also features under the 'General Services' category.

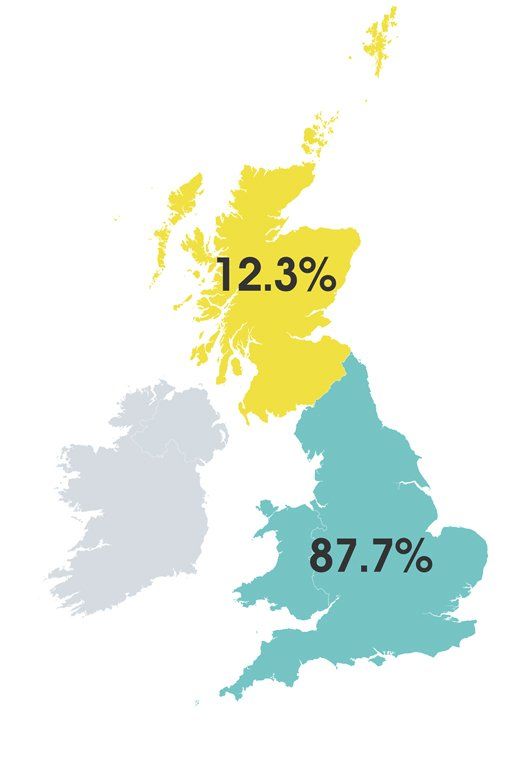

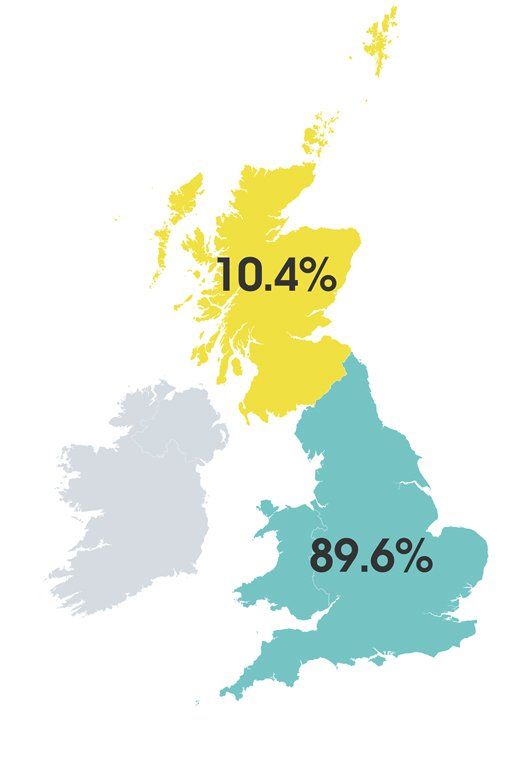

When we look at comparative Identifiable Expenditure for England and Wales and Scotland, England and Wales received 87.7% of identifiable expenditure and Scotland received 12.3%. The relative population sizes for this year were 89.6% and 10.4%.

The Catto report concludes:

'The results thrown up by the 1932 and 1935 Returns showed that Scotland’s share of the allocated expenditure was greater proportionately than her contribution to revenue and that the balance of her revenue available for General expenditure was less than her proportion of the population of Great Britain would suggest. It would, however, be wrong to conclude in the absence of other information that too much was being spent on Scottish services. The reverse might well be the case since lower revenue might be symptomatic of unfavourable industrial or trade conditions that might in turn give rise to the need for increased expenditure.'

TOTAL REVENUE

1952-1953

RELATIVE IDENTIFIABLE EXPENDITURE

1952-1953

RELATIVE POPULATION FIGURES

1952-1953

In 1958 there was an attempt to 'exorcise' the Goschen formula by the Treasury, however, identifiable expenditure remained higher largely due to a need to manage the consequences of the continued decline of Scotland's traditional industry [1].

The Goschen formula was ultimately replaced by the Barnett Formula in 1979, which was devised to acknowledge that public spending needs in Scotland were higher due to a relatively poor health record, greater dependence on local authority housing, a higher proportion of young people in education and the increased costs of providing public services in sparsely populated areas. [1].

1980-2000

Since 1992 the Scottish Government has published the Government and Expenditure Revenue Scotland (GERS) document. This document provides an overview of taxes and other government income and expenditure in and for Scotland. The Scottish Government's Chief Statisticians office also produced historical figures backdated to 1980 [6].

The GERS figures show that, largely due to a geographic share of Oil & Gas Revenues, Scotland was a net contributor to the UK from 1980 to 1989, however from 1990 to 2000 Scotland ran a net fiscal deficit.

CONCLUSION

The analysis carried out in this article concurs with the consensus amongst historians and economists that throughout the 20th century, for most years where data is available, Scotland has enjoyed a higher level of public expenditure than the rest of the UK. This is mostly due to deliberate policy by the UK Government via Goschen and Barnett. From a revenue standpoint, Scotland contributed slightly less per head than England and Wales over the early 20th century. Due to Oil & Gas revenue, from 1980 to 2000 Scotland's revenue per head was consistently higher than the rest of the UK. However, due to higher expenditure, the net fiscal balance was only positive from 1980 to 1989.

It is worth noting that when discussing these 'fiscal transfers', regardless of direction, it is wrong to think of them as subsidies. Fiscal transfers are a natural by-product of an integrated economy where regional spend has no direct relation to where the revenue is raised.

Gavin McCrone sums this up in his paper [2]:

'Fiscal transfers between regions in a modern state are of course to be expected, where there is a uniform system of taxation and a commitment to comparable standards of service. Expenditure is unrelated to tax revenue raised in a particular area: the balance between the two is generally regarded as unimportant, and statistics to discover how the two relate to each other seldom exist. Nevertheless the popular press sometimes refer to such transfers as subsidies. That is inappropriate. Whichever the direction of the transfers, decision to subsidise anything but from the automatic operation of the tax system and national public expenditure decisions.'

REFERENCES & FOOTNOTES

REFERENCES

[3] H.B. Peebles. Warship Building on the Clyde, 1987, John Donald Publishers Ltd. ISBN 10: 0859761932

[4] Scottish Financial and Trade Statistics, (Report of the Catto Committee), Cmd 8609

[6] Government Expenditure Revenue Scotland Historical

PARLIAMENTARY SESSION PAPERS

The following Parliamentary session papers were utilised in the production of this article, however, due to the license under which they were obtained we are unable to print them in full. You can obtain the papers with a valid ProQuest

account or, as we did, by visiting the House of Commons Archive

service, which is free to visit. However, we have provided the tabular data used in the charts in this article - please click below to view.

REVENUE AND EXPENDITURE (England, Scotland and Ireland) PAPERS

- 1899-1900, 1900 paper 336

- 1900-1901, 1901 paper 182

- 1901-1902, 1902 paper 256

- 1902-1903, 1903 paper 248

- 1903-1904, 1904 paper 225

- 1904-1905, 1905 paper 230

- 1905-1906, 1906 paper 278

- 1906-1907, 1907 paper 245

- 1907-1908, 1908 paper 216

- 1908-1909, 1909 paper 208

- 1909-1910, 1910 paper 233

- 1910-1911, 1911 paper 220

- 1911-1912, 1912 paper 190

- 1912-1913, 1913 paper 200

- 1913-1914, 1914 paper 387

- 1914-1915, 1915 paper 309

- 1915-1916, 1916 paper 119

- 1916-1917, 1917 paper 134

- 1917-1918, 1918 paper 106

- 1918-1919, 1919 paper 163

- 1919-1920, 1920 paper 245

- 1920-1921, 1921 paper 207

REVENUE AND EXPENDITURE (England and Scotland) PAPERS

- 1931-1932, 1932 paper 5

- 1934-1935, 1935 paper 5010

REVENUE AND EXPENDITURE (England, Wales and Scotland) PAPERS

- 1952-1953, 1953 paper 9051